What Are Life Settlements?

A life settlement (or more specifically, a senior life settlement, as they are known) is the term given to describe when an individual (usually someone in their 70’s or 80’s) sells an existing life insurance policy they own to a third party -- a person or an entity other than the company that issued the policy -- for more than the policy's cash surrender value, but less than the death benefit amount. The investor then services the policy until the passing of the insured (maturity of the policy) and collects the death benefit. Historically, the investors for these life settlments have been large, institutional players (the "Big, Smart money"). However, a law was passed in California in the year 2000 regulating how financially qualified California individual investors can participate.

Most people who own a life insurance policy that they no longer want, need, or no longer can afford, generally think they only have 2 options: they can either surrender the policy for its cash surrender value (CSV) or allow the policy to lapse.

A life settlement presents a third, often more profitable choice to these insureds: They can sell their policy (and the associated right to receive the death benefit upon their passing) to an investor. The process of conducting such a sale is referred to as a life settlement, and the resulting investment that the buyer holds is also referred to a life settlement investment. If you are a California resident and qualify, reach out today to see if and how a modest slice of your investment portfolio could make sense for you. We'll work together and answer all your questions to see if it is a good fit given your personal situation.

Life settlements have essentially no correlation to stock or financial markets, oil prices, geopolitical events, or other traditional investments. Investing in life settlements can offer outstanding return potential while reducing overall risk in a portfolio.

Cash Surrender Value vs. Secondary Market

Until recently, the only option a policy owner had was to surrender their policy back to the insurance company. With the advent of life settlements, an insured can now sell their policy on the secondary market for an amount much greater than its cash surrender value.

Over the last decade, life settlements have permitted seniors to sell their unneeded or unwanted policies at significantly better market values than they would have received by simply surrendering the policy. In today’s world, where many seniors have lost significant portions of their retirement assets and income, selling their policy for substantially more than its cash value can make a tremendous difference in their lives. As an investor in this asset class, you are in fact helping seniors maintain their quality of life.

Why Choose Us

Desirable Policies

Policy selection and acquisition is key. That is why many millions of dollars of life insurance policies are reviewed before any are acquired and offered up for investment. A rigorous methodology and adherence to strict criteria are employed, such that only those policies determined to represent what we believe to be good opportunities for our investors are selected. Positive outcomes and subsequent reinvestment where it makes sense for our clients and referrals are central to our business model, aligning our interests with our clients.

Life Expectancy (LE) Reports

One of the most important elements to life settlement investing is the life expectancy estimation. All life expectancy estimate reports are performed by a third-party underwriting laboratory who is licensed to provide these calculations and analyses, and this information is disclosed to you prior to any investment.

Experienced Professional Advisor

We have been helping clients with their wealth and helping financial advisors grow and improve their practices for more than 20 years. You will find us to be knowledgeable and responsive as we treat every client like they are our only client. The motto of Alternative Strategies is: 'Take care of the client's needs in everything we do, and the rest will take care of itself.'

LLC Policy Ownership Structure with Secure Reserve Accounts

Investor funds are securely held in the Policy Maintenance Reserve Account administered by a large, experienced 3rd party bank. Investors are members of the LLC that owns the policies. When the life insurance policy matures, the death benefit is paid out promptly and proportionally to all investors. Maturity proceeds are paid directly to the investors upon EACH maturity - you do NOT have to wait for all policies to mature to begin to see your return.

Strong Returns Through Bull Markets and Bears...

Life Settlement Performance During 2008 Crisis

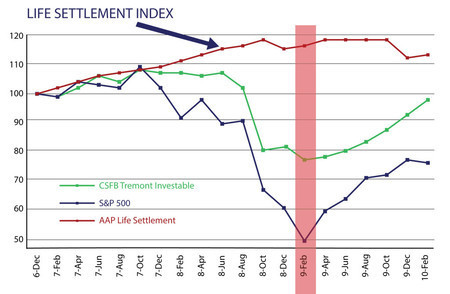

The AAP Life Settlement Index has been used to track the performance of funds implementing an investment strategy in U.S. life insurance policies (“life settlements”) and serves as a transparent benchmark for the overall life settlement market.

During the "2008 economic crisis", life settlements performed well against other indices, including the S&P 500 equity index, Credit Suisse’s Hedge Fund and U.S. Bonds. With essentially no correlation to other markets, life settlements can act as a defensive strategy to reduce the overall volatility of an investor’s portfolio and potentially improve long-term results.

Perhaps this is why institutional investors have invested $Billions into life settlements over the last few decades.

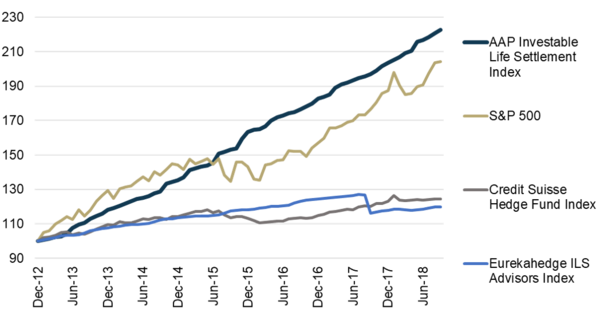

During a recent 11-year historic bull market, the AAP Life Settlement Index also confirmed life settlements' relatively steady performance, resilience and continued relevance, even during boom times.

In fact, the AAP Life Settlement Index showed that life settlements outperformed the S&P 500 during the majority of this period. Your results may vary and past performance is no guarantee of future results.

Life Settlement Performance During The Most Recent Bull Market

What Our Investors Say About Us

“Brian at Alternative Strategies helped me to understand life settlement investments and explained that some policies would probably go ‘long’ and some would probably go ‘short’ and so far over the last handful of years that has been the case. While some policies have yielded just single-digit annual returns, my most recent maturity returned a 25% annual return over the last four years, which has helped bring my average up nicely.”

Charles

La Jolla, CA

“You won’t find a more conscientious and thorough financial professional than Brian at Alternative Strategies Insurance Solutions. He answered all my questions and shared so much information and detail with me such that I felt confident I understood what I was investing in, and how it all worked. It is a longer-term investment, but I really like knowing some of my money is disconnected from the stock and real estate markets given everything going on these days.”

David

Roseville, CA

“Mr. Clark of Alternative Strategies Insurance Solutions is experienced, knowledgeable and most importantly, I believe honest. I have found in my dealings with him that he truly strives to make sure the investors he works with know the benefits and risks of what they are investing in and I feel he wants to always make sure investments, like life settlements, are well understood by his clients before they invest. The diversification he helped bring to my portfolio has given me peace of mind no matter what the stock market is doing or what’s in the news.”

William

San Diego, CA

Frequently Asked Questions

*We do not provide tax or legal advice. Seek advice from your own financial, legal and tax advisors. Any and all guarantees are subject to the claims-paying abilities of the underlying insurance company. The $250,000 minimum net worth requirement is per California law and excludes an investor's primary home, vehicles and home furnishings. Investors should read and understand all related investment information and risks and need to have the appropriate time horizon, risk tolerance and liquidity to invest in life settlements.

CA Life License #0D02647